Bandit based centralized matching in two-sided markets for peer to peer lending

Paper and Code

May 06, 2021

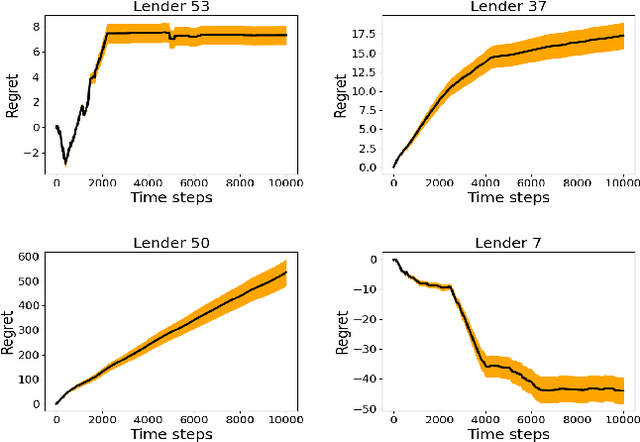

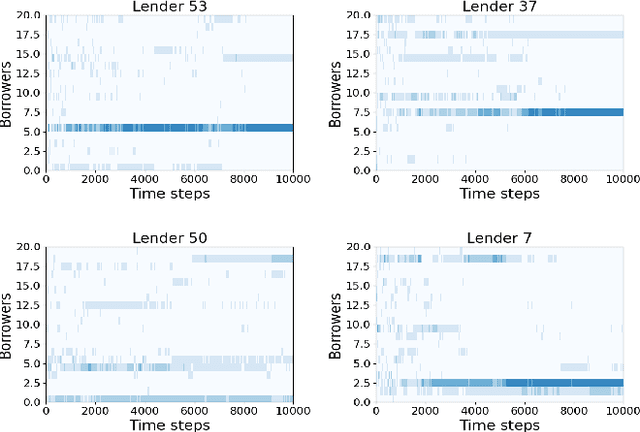

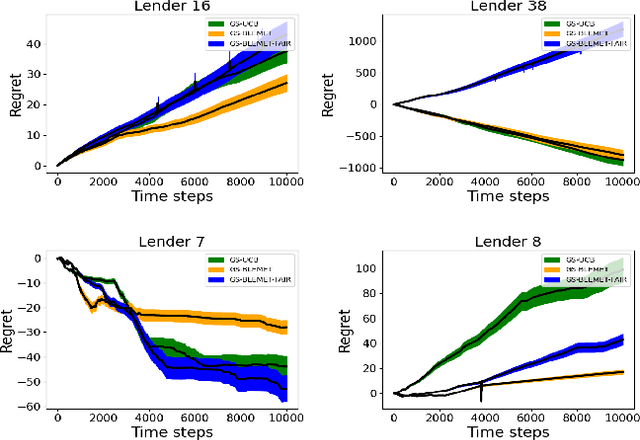

Sequential fundraising in two sided online platforms enable peer to peer lending by sequentially bringing potential contributors, each of whose decisions impact other contributors in the market. However, understanding the dynamics of sequential contributions in online platforms for peer lending has been an open ended research question. The centralized investment mechanism in these platforms makes it difficult to understand the implicit competition that borrowers face from a single lender at any point in time. Matching markets are a model of pairing agents where the preferences of agents from both sides in terms of their preferred pairing for transactions can allow to decentralize the market. We study investment designs in two sided platforms using matching markets when the investors or lenders also face restrictions on the investments based on borrower preferences. This situation creates an implicit competition among the lenders in addition to the existing borrower competition, especially when the lenders are uncertain about their standing in the market and thereby the probability of their investments being accepted or the borrower loan requests for projects reaching the reserve price. We devise a technique based on sequential decision making that allows the lenders to adjust their choices based on the dynamics of uncertainty from competition over time. We simulate two sided market matchings in a sequential decision framework and show the dynamics of the lender regret amassed compared to the optimal borrower-lender matching and find that the lender regret depends on the initial preferences set by the lenders which could affect their learning over decision making steps.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge