Are Graph Representation Learning Methods Robust to Graph Sparsity and Asymmetric Node Information?

Paper and Code

May 19, 2022

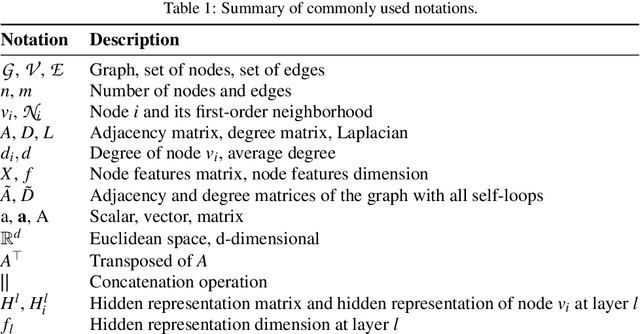

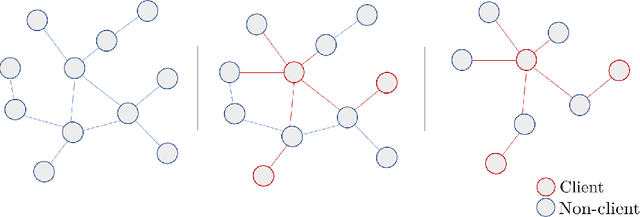

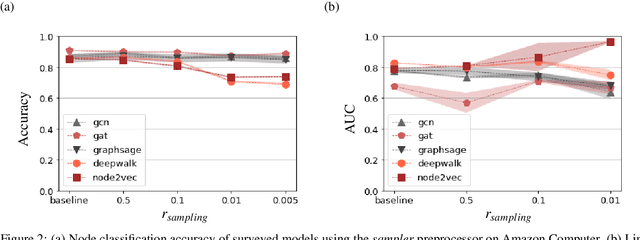

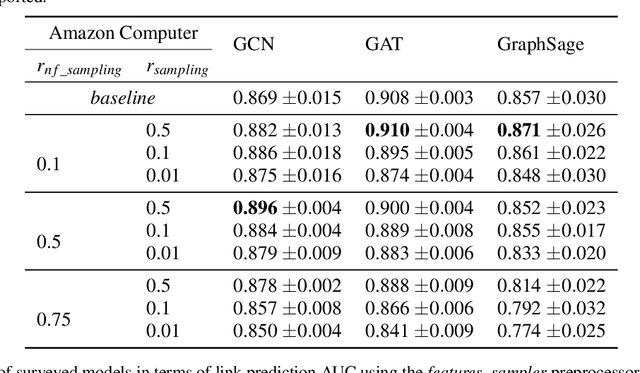

The growing popularity of Graph Representation Learning (GRL) methods has resulted in the development of a large number of models applied to a miscellany of domains. Behind this diversity of domains, there is a strong heterogeneity of graphs, making it difficult to estimate the expected performance of a model on a new graph, especially when the graph has distinctive characteristics that have not been encountered in the benchmark yet. To address this, we have developed an experimental pipeline, to assess the impact of a given property on the models performances. In this paper, we use this pipeline to study the effect of two specificities encountered on banks transactional graphs resulting from the partial view a bank has on all the individuals and transactions carried out on the market. These specific features are graph sparsity and asymmetric node information. This study demonstrates the robustness of GRL methods to these distinctive characteristics. We believe that this work can ease the evaluation of GRL methods to specific characteristics and foster the development of such methods on transactional graphs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge