Application of Deep Reinforcement Learning to Payment Fraud

Paper and Code

Dec 08, 2021

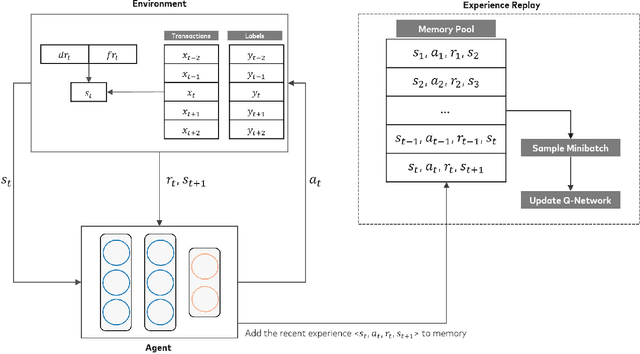

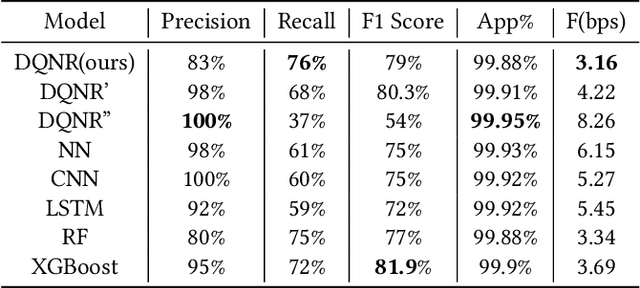

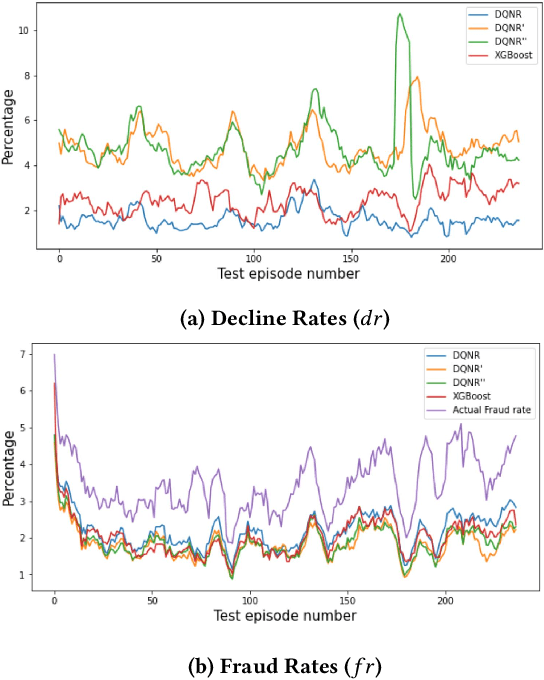

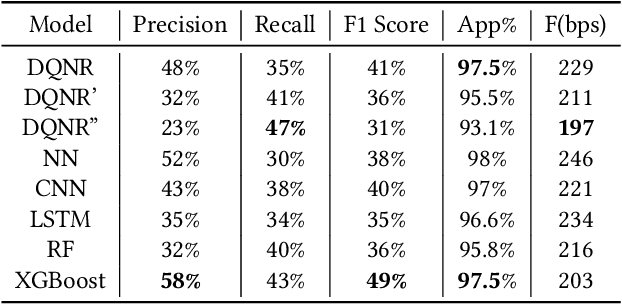

The large variety of digital payment choices available to consumers today has been a key driver of e-commerce transactions in the past decade. Unfortunately, this has also given rise to cybercriminals and fraudsters who are constantly looking for vulnerabilities in these systems by deploying increasingly sophisticated fraud attacks. A typical fraud detection system employs standard supervised learning methods where the focus is on maximizing the fraud recall rate. However, we argue that such a formulation can lead to sub-optimal solutions. The design requirements for these fraud models requires that they are robust to the high-class imbalance in the data, adaptive to changes in fraud patterns, maintain a balance between the fraud rate and the decline rate to maximize revenue, and be amenable to asynchronous feedback since usually there is a significant lag between the transaction and the fraud realization. To achieve this, we formulate fraud detection as a sequential decision-making problem by including the utility maximization within the model in the form of the reward function. The historical decline rate and fraud rate define the state of the system with a binary action space composed of approving or declining the transaction. In this study, we primarily focus on utility maximization and explore different reward functions to this end. The performance of the proposed Reinforcement Learning system has been evaluated for two publicly available fraud datasets using Deep Q-learning and compared with different classifiers. We aim to address the rest of the issues in future work.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge