An Overview on the Landscape of R Packages for Credit Scoring

Paper and Code

Jul 02, 2020

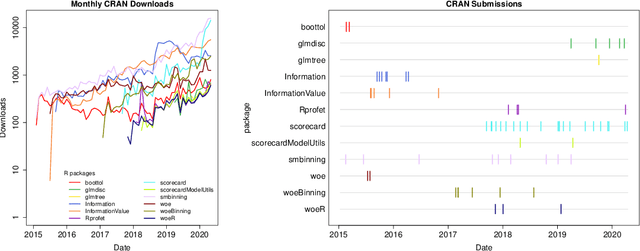

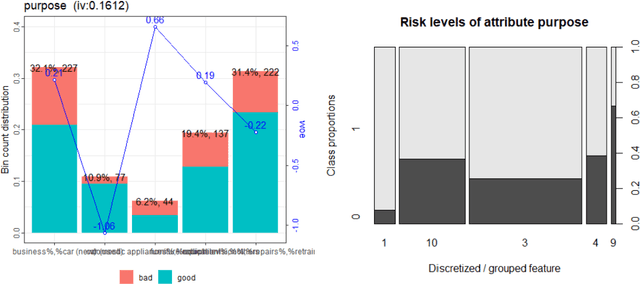

The credit scoring industry has a long tradition of using statistical tools for loan default probability prediction and domain specific standards have been established long before the hype of machine learning. Although several commercial software companies offer specific solutions for credit scorecard modelling in R explicit packages for this purpose have been missing long time. In the recent years this has changed and several packages have been developed which are dedicated to credit scoring. The aim of this paper is to give a structured overview on these packages. This may guide users to select the appropriate functions for a desired purpose and further hopefully will contribute to directing future development activities. The paper is guided by the chain of subsequent modelling steps as they are forming the typical scorecard development process.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge