A Survey of Credit Card Fraud Detection Techniques: Data and Technique Oriented Perspective

Paper and Code

Nov 19, 2016

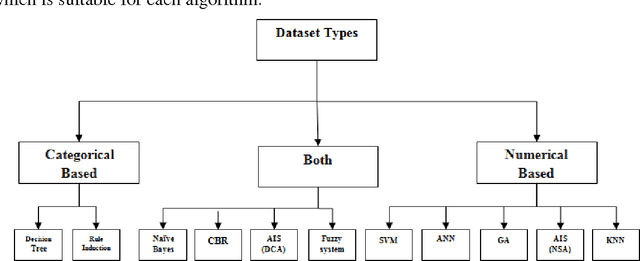

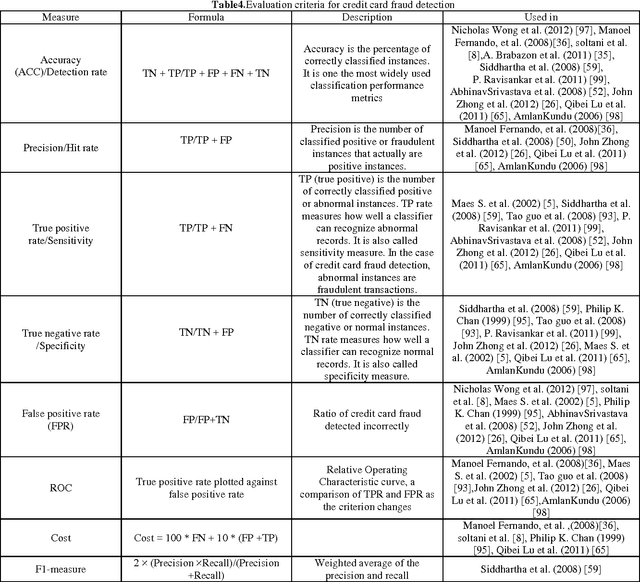

Credit card plays a very important rule in today's economy. It becomes an unavoidable part of household, business and global activities. Although using credit cards provides enormous benefits when used carefully and responsibly,significant credit and financial damages may be caused by fraudulent activities. Many techniques have been proposed to confront the growth in credit card fraud. However, all of these techniques have the same goal of avoiding the credit card fraud; each one has its own drawbacks, advantages and characteristics. In this paper, after investigating difficulties of credit card fraud detection, we seek to review the state of the art in credit card fraud detection techniques, data sets and evaluation criteria.The advantages and disadvantages of fraud detection methods are enumerated and compared.Furthermore, a classification of mentioned techniques into two main fraud detection approaches, namely, misuses (supervised) and anomaly detection (unsupervised) is presented. Again, a classification of techniques is proposed based on capability to process the numerical and categorical data sets. Different data sets used in literature are then described and grouped into real and synthesized data and the effective and common attributes are extracted for further usage.Moreover, evaluation employed criterions in literature are collected and discussed.Consequently, open issues for credit card fraud detection are explained as guidelines for new researchers.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge