A refinement of Bennett's inequality with applications to portfolio optimization

Paper and Code

Apr 16, 2018

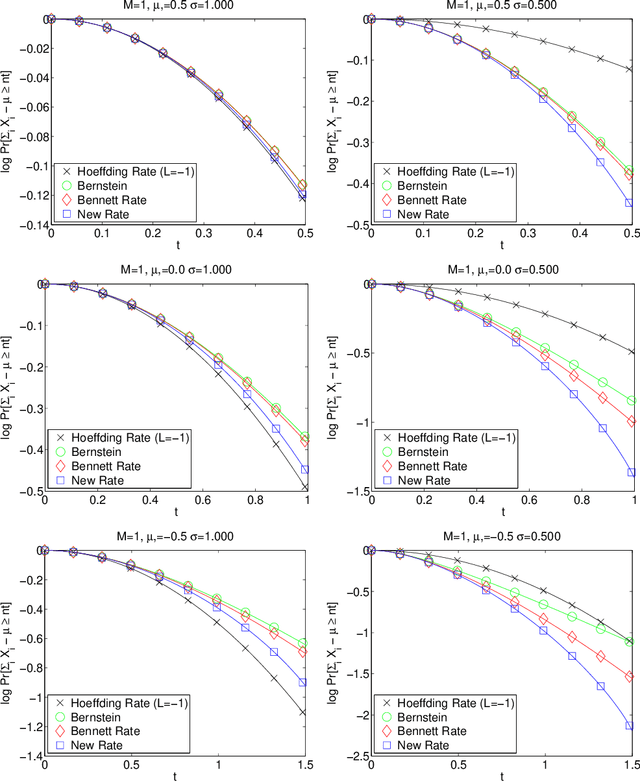

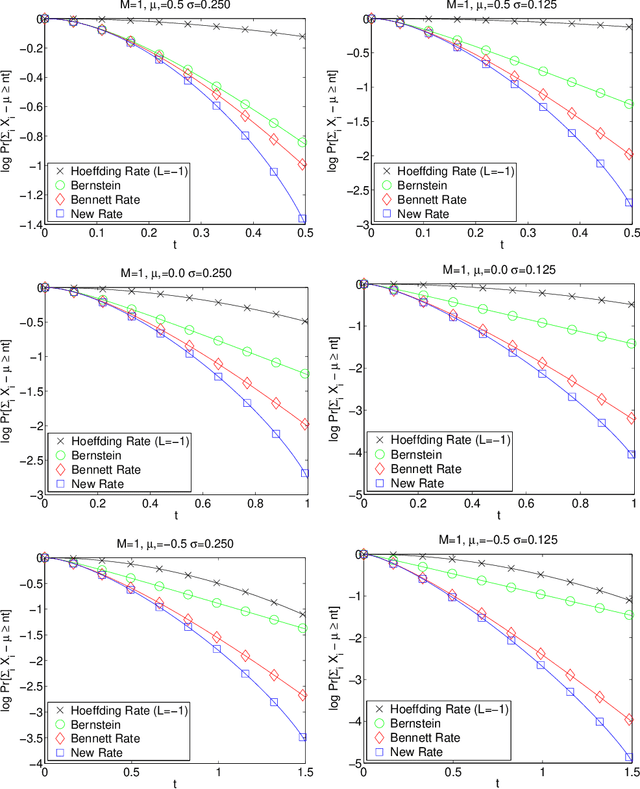

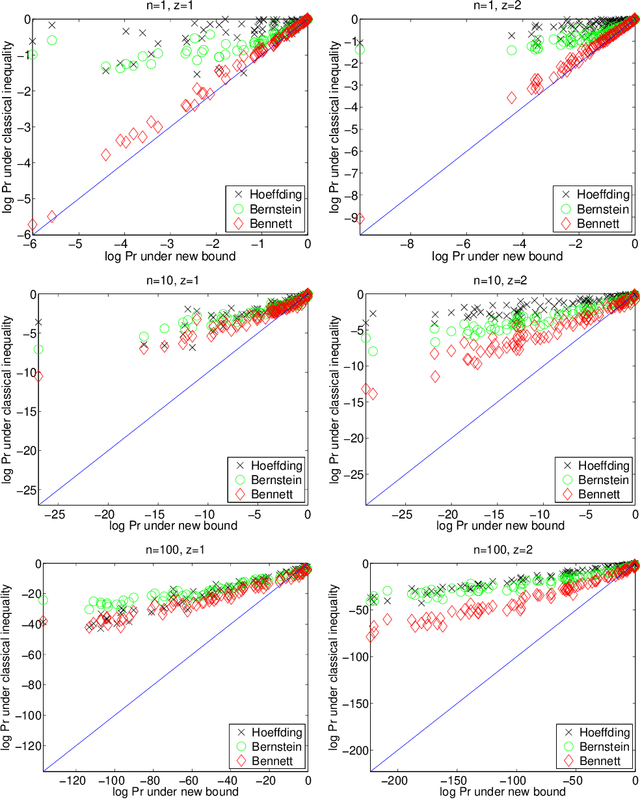

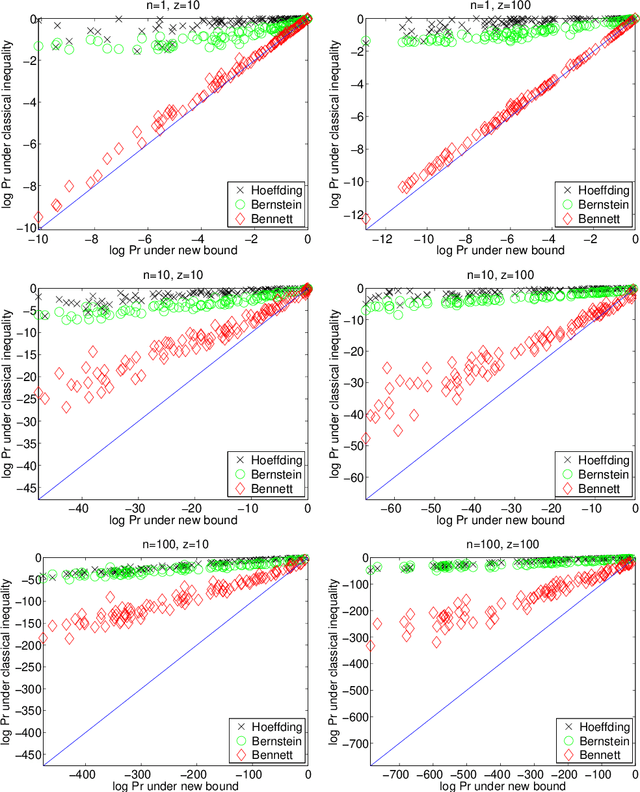

A refinement of Bennett's inequality is introduced which is strictly tighter than the classical bound. The new bound establishes the convergence of the average of independent random variables to its expected value. It also carefully exploits information about the potentially heterogeneous mean, variance, and ceiling of each random variable. The bound is strictly sharper in the homogeneous setting and very often significantly sharper in the heterogeneous setting. The improved convergence rates are obtained by leveraging Lambert's W function. We apply the new bound in a portfolio optimization setting to allocate a budget across investments with heterogeneous returns.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge