Sungbin Sohn

Predicting Recession Probabilities Using Term Spreads: New Evidence from a Machine Learning Approach

Jan 23, 2021

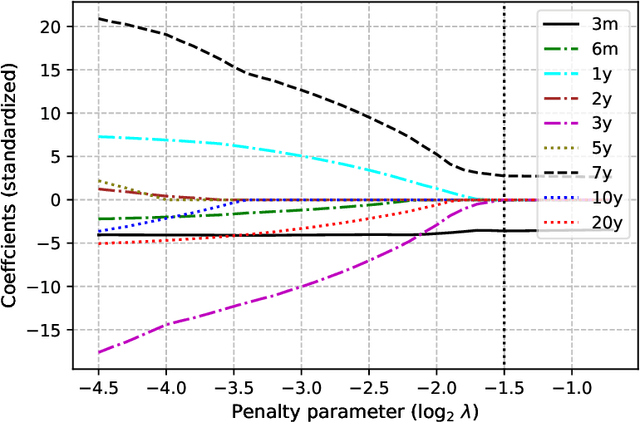

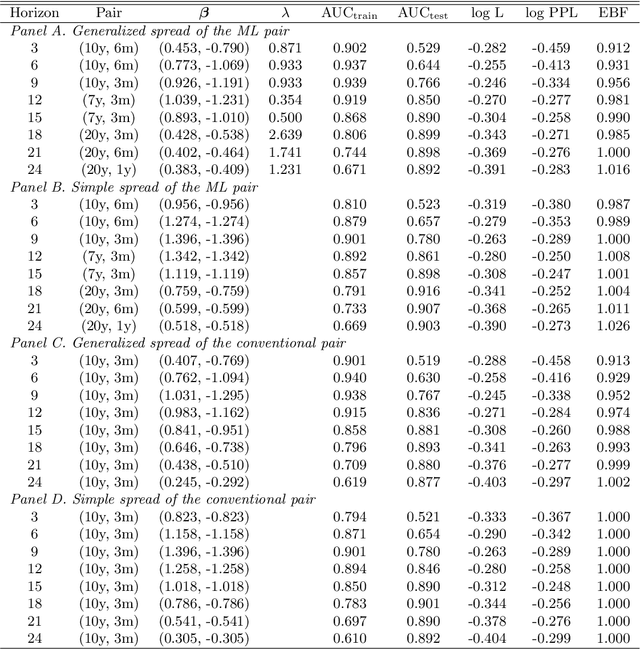

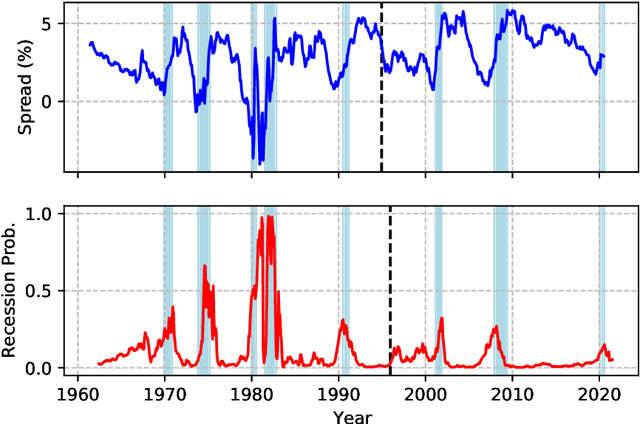

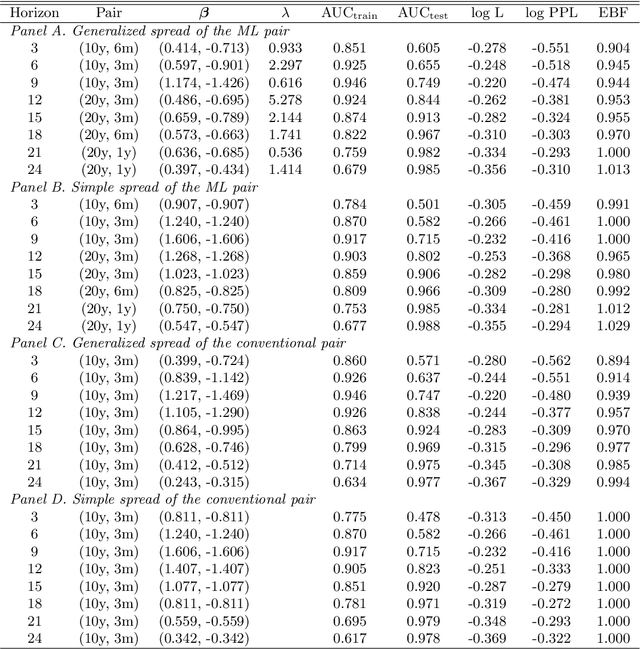

Abstract:The literature on using yield curves to forecast recessions typically measures the term spread as the difference between the 10-year and the three-month Treasury rates. Furthermore, using the term spread constrains the long- and short-term interest rates to have the same absolute effect on the recession probability. In this study, we adopt a machine learning method to investigate whether the predictive ability of interest rates can be improved. The machine learning algorithm identifies the best maturity pair, separating the effects of interest rates from those of the term spread. Our comprehensive empirical exercise shows that, despite the likelihood gain, the machine learning approach does not significantly improve the predictive accuracy, owing to the estimation error. Our finding supports the conventional use of the 10-year--three-month Treasury yield spread. This is robust to the forecasting horizon, control variable, sample period, and oversampling of the recession observations.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge