Rajesh Kumar Jha

Flight Delay Prediction using Hybrid Machine Learning Approach: A Case Study of Major Airlines in the United States

Sep 01, 2024Abstract:The aviation industry has experienced constant growth in air traffic since the deregulation of the U.S. airline industry in 1978. As a result, flight delays have become a major concern for airlines and passengers, leading to significant research on factors affecting flight delays such as departure, arrival, and total delays. Flight delays result in increased consumption of limited resources such as fuel, labor, and capital, and are expected to increase in the coming decades. To address the flight delay problem, this research proposes a hybrid approach that combines the feature of deep learning and classic machine learning techniques. In addition, several machine learning algorithms are applied on flight data to validate the results of proposed model. To measure the performance of the model, accuracy, precision, recall, and F1-score are calculated, and ROC and AUC curves are generated. The study also includes an extensive analysis of the flight data and each model to obtain insightful results for U.S. airlines.

Machine Learning Approaches to Real Estate Market Prediction Problem: A Case Study

Aug 22, 2020

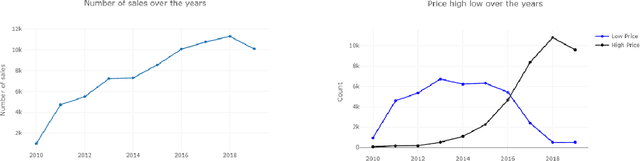

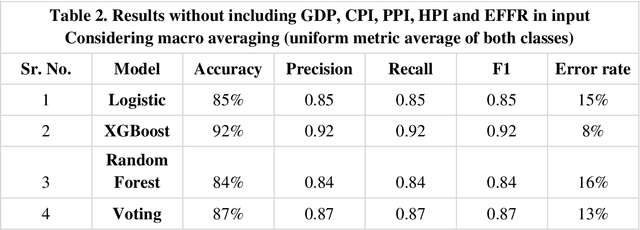

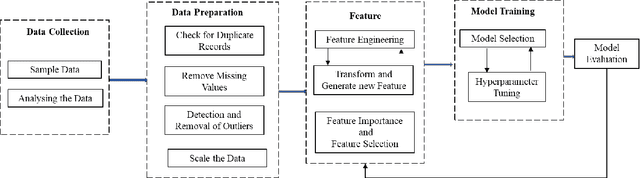

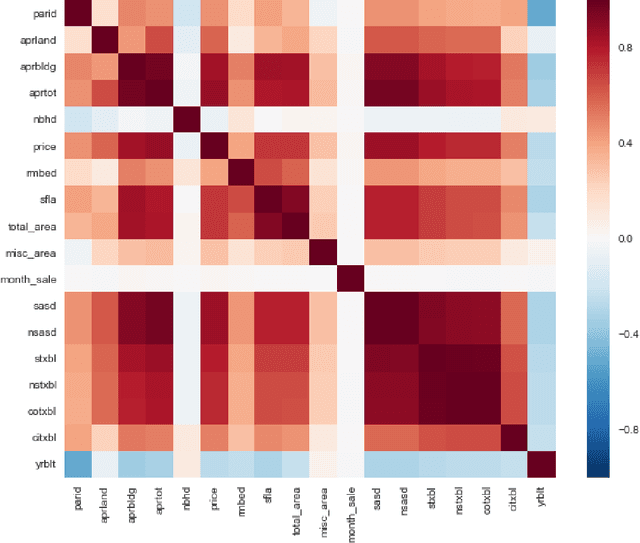

Abstract:Home sale prices are formed given the transaction actors economic interests, which include government, real estate dealers, and the general public who buy or sell properties. Generating an accurate property price prediction model is a major challenge for the real estate market. This work develops a property price classification model using a ten year actual dataset, from January 2010 to November 2019. The real estate dataset is publicly available and was retrieved from Volusia County Property Appraiser of Florida website. In addition, socio-economic factors such as Gross Domestic Product, Consumer Price Index, Producer Price Index, House Price Index, and Effective Federal Funds Rate are collected and used in the prediction model. To solve this case study problem, several powerful machine learning algorithms, namely, Logistic Regression, Random Forest, Voting Classifier, and XGBoost, are employed. They are integrated with target encoding to develop an accurate property sale price prediction model with the aim to predict whether the closing sale price is greater than or less than the listing sale price. To assess the performance of the models, the accuracy, precision, recall, classification F1 score, and error rate of the models are determined. Among the four studied machine learning algorithms, XGBoost delivers superior results and robustness of the model compared to other models. The developed model can facilitate real estate investors, mortgage lenders and financial institutions to make better informed decisions.

Housing Market Prediction Problem using Different Machine Learning Algorithms: A Case Study

Jun 17, 2020

Abstract:Developing an accurate prediction model for housing prices is always needed for socio-economic development and well-being of citizens. In this paper, a diverse set of machine learning algorithms such as XGBoost, CatBoost, Random Forest, Lasso, Voting Regressor, and others, are being employed to predict the housing prices using public available datasets. The housing datasets of 62,723 records from January 2015 to November 2019 are obtained from Florida Volusia County Property Appraiser website. The records are publicly available and include the real estate or economic database, maps, and other associated information. The database is usually updated weekly according to the State of Florida regulations. Then, the housing price prediction models using machine learning techniques are developed and their regression model performances are compared. Finally, an improved housing price prediction model for assisting the housing market is proposed. Particularly, a house seller or buyer, or a real estate broker can get insight in making better-informed decisions considering the housing price prediction. The empirical results illustrate that based on prediction model performance, Coefficient of Determination (R2), Mean Square Error (MSE), Mean Absolute Error (MAE), and computational time, the XGBoost algorithm performs superior to the other models to predict the housing price.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge