Fadi Amroush

AI-Assisted Investigation of On-Chain Parameters: Risky Cryptocurrencies and Price Factors

Aug 11, 2023

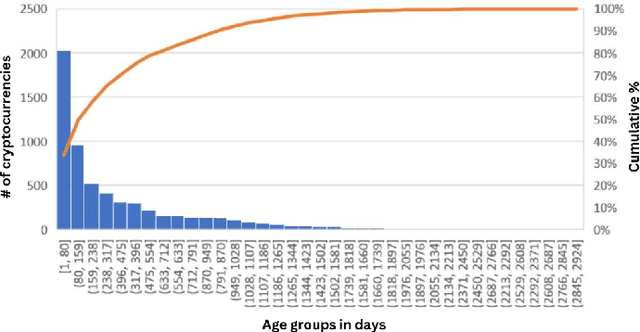

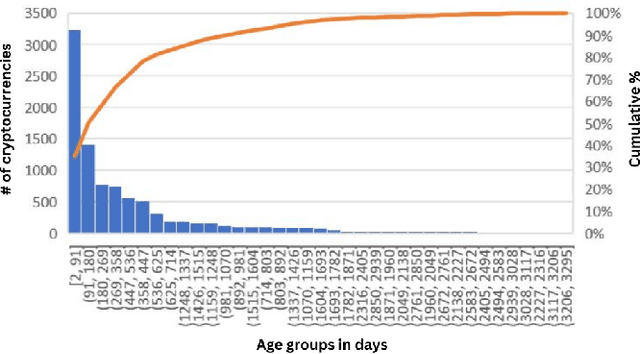

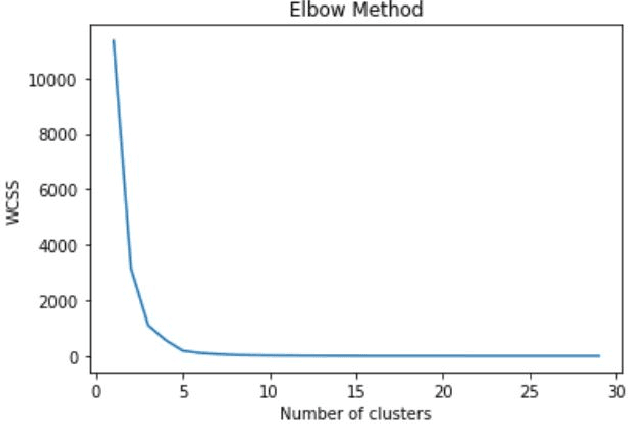

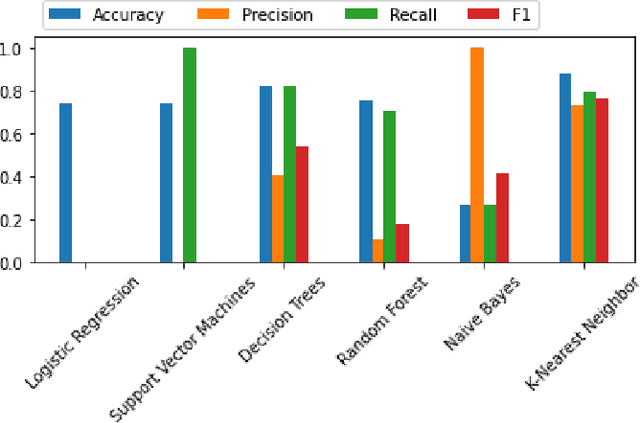

Abstract:Cryptocurrencies have become a popular and widely researched topic of interest in recent years for investors and scholars. In order to make informed investment decisions, it is essential to comprehend the factors that impact cryptocurrency prices and to identify risky cryptocurrencies. This paper focuses on analyzing historical data and using artificial intelligence algorithms on on-chain parameters to identify the factors affecting a cryptocurrency's price and to find risky cryptocurrencies. We conducted an analysis of historical cryptocurrencies' on-chain data and measured the correlation between the price and other parameters. In addition, we used clustering and classification in order to get a better understanding of a cryptocurrency and classify it as risky or not. The analysis revealed that a significant proportion of cryptocurrencies (39%) disappeared from the market, while only a small fraction (10%) survived for more than 1000 days. Our analysis revealed a significant negative correlation between cryptocurrency price and maximum and total supply, as well as a weak positive correlation between price and 24-hour trading volume. Moreover, we clustered cryptocurrencies into five distinct groups using their on-chain parameters, which provides investors with a more comprehensive understanding of a cryptocurrency when compared to those clustered with it. Finally, by implementing multiple classifiers to predict whether a cryptocurrency is risky or not, we obtained the best f1-score of 76% using K-Nearest Neighbor.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge