Adam J. Makarucha

Assessing Regulatory Risk in Personal Financial Advice Documents: a Pilot Study

Oct 11, 2019

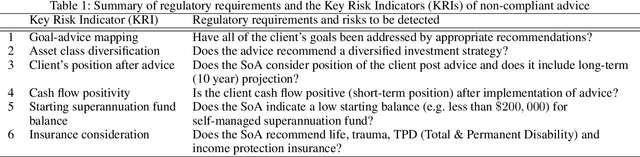

Abstract:Assessing regulatory compliance of personal financial advice is currently a complex manual process. In Australia, only 5%- 15% of advice documents are audited annually and 75% of these are found to be non-compliant(ASI 2018b). This paper describes a pilot with an Australian government regulation agency where Artificial Intelligence (AI) models based on techniques such natural language processing (NLP), machine learning and deep learning were developed to methodically characterise the regulatory risk status of personal financial advice documents. The solution provides traffic light rating of advice documents for various risk factors enabling comprehensive coverage of documents in the review and allowing rapid identification of documents that are at high risk of non-compliance with government regulations. This pilot serves as a case study of public-private partnership in developing AI systems for government and public sector.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge