Probabilistic forecasting of German electricity imbalance prices

Paper and Code

May 23, 2022

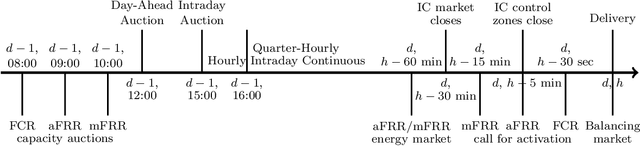

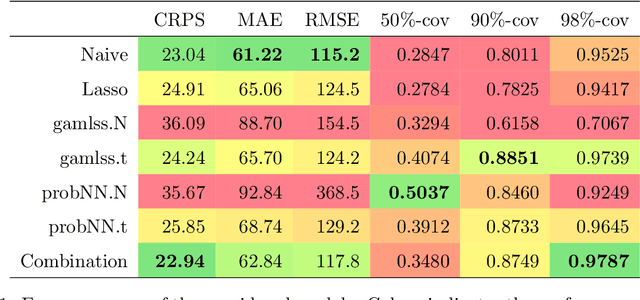

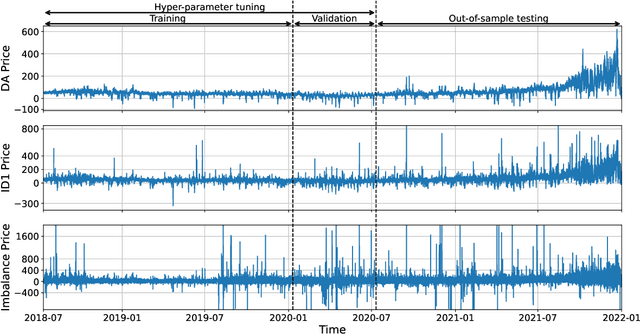

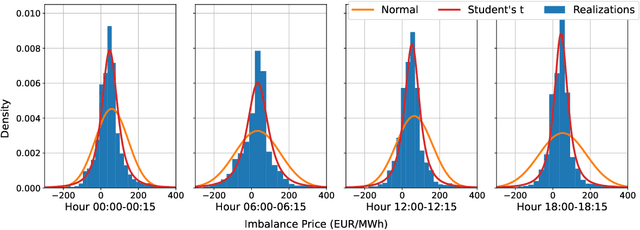

The exponential growth of renewable energy capacity has brought much uncertainty to electricity prices and to electricity generation. To address this challenge, the energy exchanges have been developing further trading possibilities, especially the intraday and balancing markets. For an energy trader participating in both markets, the forecasting of imbalance prices is of particular interest. Therefore, in this manuscript we conduct a very short-term probabilistic forecasting of imbalance prices, contributing to the scarce literature in this novel subject. The forecasting is performed 30 minutes before the delivery, so that the trader might still choose the trading place. The distribution of the imbalance prices is modelled and forecasted using methods well-known in the electricity price forecasting literature: lasso with bootstrap, gamlss, and probabilistic neural networks. The methods are compared with a naive benchmark in a meaningful rolling window study. The results provide evidence of the efficiency between the intraday and balancing markets as the sophisticated methods do not substantially overperform the intraday continuous price index. On the other hand, they significantly improve the empirical coverage. The analysis was conducted on the German market, however it could be easily applied to any other market of similar structure.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge