Empirical effect of graph embeddings on fraud detection/ risk mitigation

Paper and Code

Mar 05, 2019

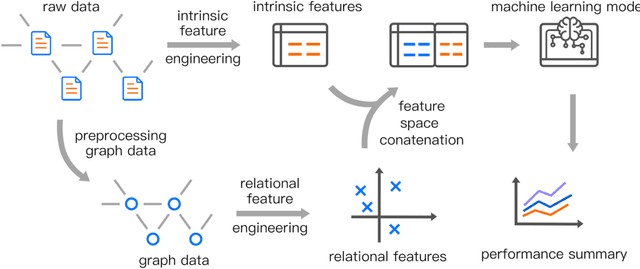

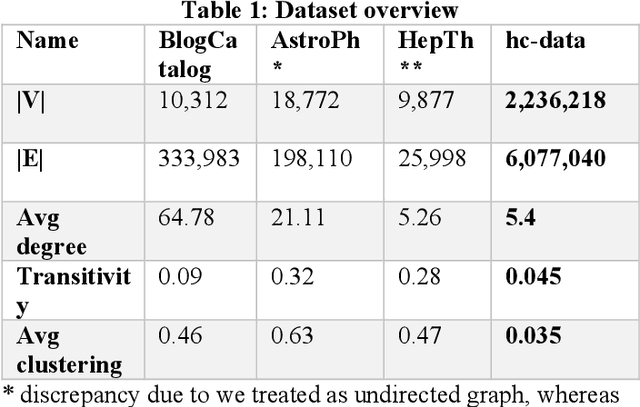

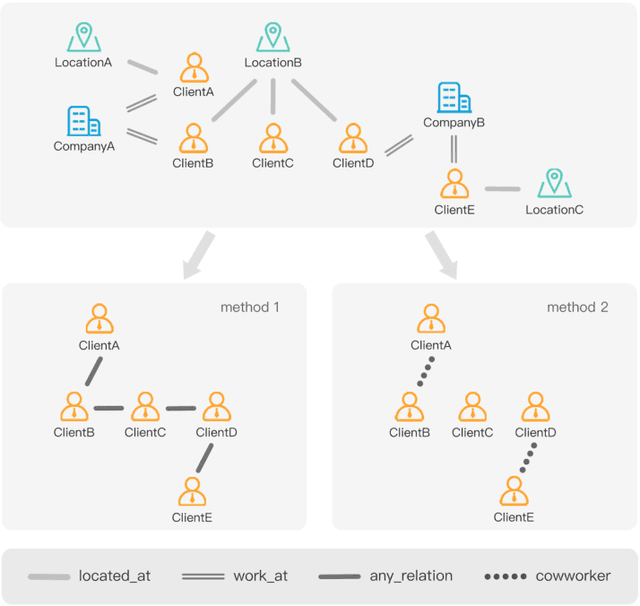

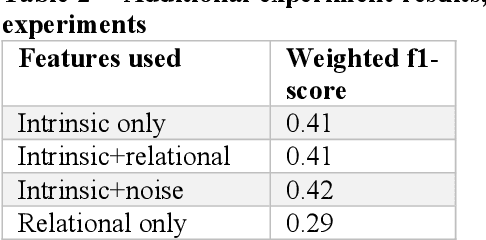

Graph embedding technics are studied with interest on public datasets, such as BlogCatalog, with the common practice of maximizing scoring on graph reconstruction, link prediction metrics etc. However, in the financial sector the important metrics are often more business related, for example fraud detection rates. With our privileged position of having large amount of real-world non-public P2P-lending social data, we aim to study empirically whether recent advances in graph embedding technics provide a useful signal for metrics more closely related to business interests, such as fraud detection rate.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge