Econometric Modeling of Intraday Electricity Market Price with Inadequate Historical Data

Paper and Code

Mar 11, 2022

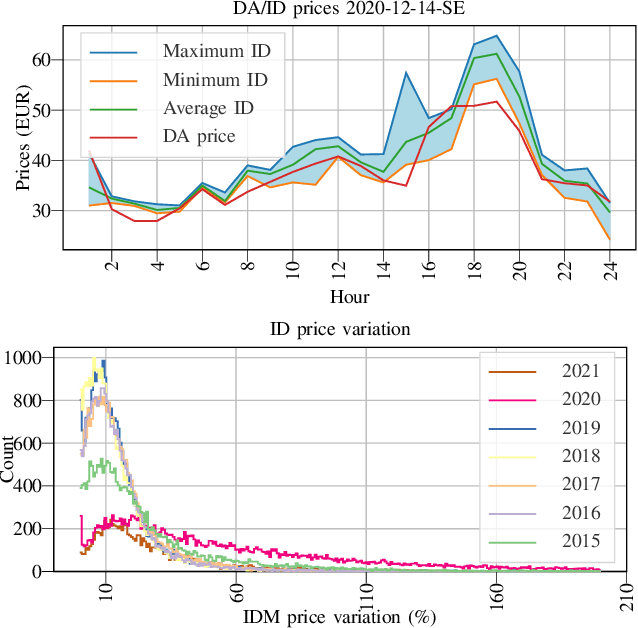

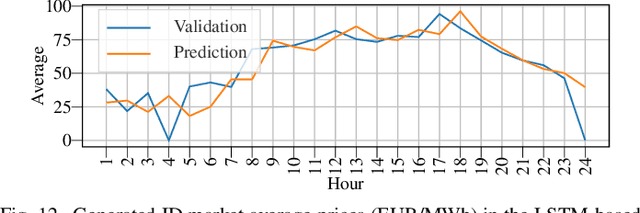

The intraday (ID) electricity market has received an increasing attention in the recent EU electricity-market discussions. This is partly because the uncertainty in the underlying power system is growing and the ID market provides an adjustment platform to deal with such uncertainties. Hence, market participants need a proper ID market price model to optimally adjust their positions by trading in the market. Inadequate historical data for ID market price makes it more challenging to model. This paper proposes long short-term memory, deep convolutional generative adversarial networks, and No-U-Turn sampler algorithms to model ID market prices. Our proposed econometric ID market price models are applied to the Nordic ID price data and their promising performance are illustrated.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge