Adaptive Hybrid Model for Enhanced Stock Market Predictions Using Improved VMD and Stacked Informer

Paper and Code

Oct 03, 2023

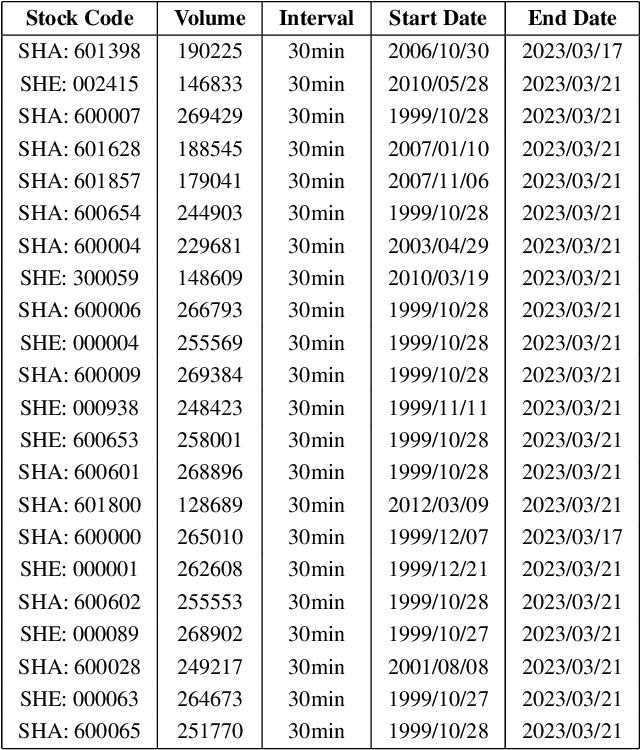

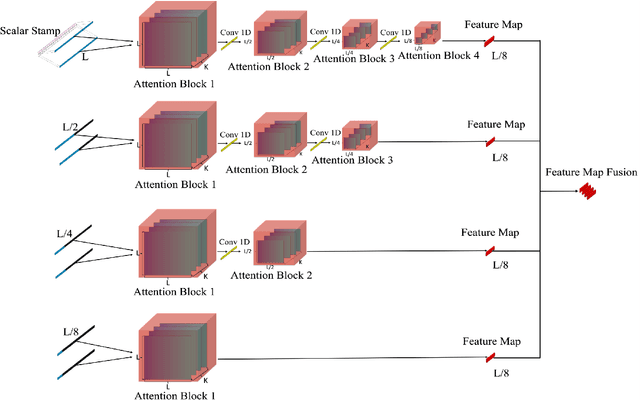

This paper introduces an innovative adaptive hybrid model for stock market predictions, leveraging the capabilities of an enhanced Variational Mode Decomposition (VMD), Feature Engineering (FE), and stacked Informer integrated with an adaptive loss function. Through rigorous experimentation, the proposed model, termed Adam+GC+enhanced informer (We name it VMGCformer), demonstrates significant proficiency in addressing the intricate dynamics and volatile nature of stock market data. Experimental results, derived from multiple benchmark datasets, underscore the model's superiority in terms of prediction accuracy, responsiveness, and generalization capabilities over traditional and other hybrid models. The research further highlights potential avenues for optimization and introduces future directions to enhance predictive modeling, especially for small enterprises and feature engineering.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge